Selling a home in 2026 brings mixed prospects as mortgage rates are expected to stay between 6-6.5% throughout the year. Rates have shown improvement and dropped below 6% to reach their lowest point since early 2023. The housing market's evolution has taken some unexpected turns.

Market forecasts for 2026 predict modest national home price growth ranging from 1.2% to 4%. The growth patterns vary significantly across regions. About 22 major metropolitan areas might experience price declines, especially in Sun Belt and Western markets. Average U.S. home prices have dropped 1.4% in the last three months. The available housing inventory sits roughly 12% below pre-pandemic levels, which creates a challenging environment to sell.

Should you sell your house in 2026? Your location and personal situation will largely determine this decision. Some market experts predict U.S. house prices will remain flat with 0% growth. Yet positive indicators emerge as home sales remain steady at 2025's end and show promise of improvement in the months ahead. This piece will help you direct your home-selling journey by examining effective strategies and comparing traditional agents with digital platforms in today's market.

Key Takeaways

The 2026 home selling market requires strategic adaptation to regional variations and evolved buyer behavior, with success depending on realistic pricing and location-specific approaches.

• Price realistically from day one - Overpriced homes sit 68% longer on market and sell for 8-10% less than correctly priced properties

• Location determines strategy - Regional differences now outweigh national trends, with Northeast/Midwest rising while Sun Belt/West Coast markets decline

• Focus on high-ROI improvements - Exterior upgrades like fresh paint (152% ROI) and landscaping (238% ROI) outperform costly interior renovations

• Choose selling method based on priorities - Traditional agents maximize price, cash buyers offer speed (21-day closings), digital platforms provide middle ground

• Climate risks now impact values - Rising insurance costs in disaster-prone areas have reduced home values by $43,900 in most affected ZIP codes

The key to success lies in understanding your specific micro-market conditions rather than following national trends, as mortgage rates between 6-6.5% have created more selective buyers who demand value and realistic pricing.

What’s Different About Selling a Home in 2026

In 2026, pricing and local market conditions matter more than national headlines.

In 2026, pricing and local market conditions matter more than national headlines.The 2026 real estate market looks quite different from past years, so sellers must adapt their strategies.

Interest rates and their effect on buyer behavior

Mortgage rates now sit between 6.0-6.5%, which has changed how buyers think about purchases. The moderate drop from recent years has boosted buying power a bit, but rates remain substantially above the sub-3% levels seen during the pandemic era. Buyers have become more selective and watch prices carefully when searching for homes.

First-time homebuyers struggle the most, and many put off their purchases because of costs. The typical monthly mortgage payment has jumped well above pre-pandemic levels. This forces buyers to look at smaller homes or consider areas they might not have picked originally.

Home prices forecast 2026: What sellers should expect

Local markets tell a better story than national trends in 2026. National forecasts point to modest growth between 1.2-4%, but approximately 22 metropolitan areas could see prices drop. Sun Belt and Western markets that boomed during the pandemic now face possible corrections.

Sellers in the Northeast and Midwest can expect stable growth throughout 2026. The right pricing strategy makes all the difference - homes with correct initial prices tend to sell faster and get better offers than those needing price cuts later.

Inventory levels and competition explained

Available housing stays about 12% below pre-pandemic levels, though it has grown steadily through 2025-26. This slow increase in available homes gives sellers some advantages, but not as much as during the pandemic rush.

Competition looks different across locations and price ranges. Entry-level homes see strong demand from first-time buyers, while luxury properties take longer to sell. Success in selling your home depends on understanding your local market conditions.

How Location Shapes Your Selling Strategy

Your home's location will make or break its sale in 2026. Regional market differences now matter more than national trends when you plan your selling strategy.

Markets where prices are rising vs. falling

Regional price differences have grown larger than ever before. The Northeast and Midwest markets show strong growth. Cincinnati leads with an 8.4% year-over-year price increase. Detroit (6.5%), Philadelphia (5.8%), and Chicago (5.6%) also perform well.

The South and West Coast markets tell a different story. Dallas and San Jose lead the decline with prices dropping 4.4% and 3.7%. Jacksonville (-2.7%), Oakland (-2.4%), and Portland (-1.8%) follow close behind. All but one of these 15 metro areas saw lower median home prices in early 2026.

Climate risk and insurance costs affecting value

Climate concerns reshape market dynamics and home values. Higher insurance premiums have cut home values by about $43,900 in areas prone to disasters. Properties face the biggest impact in hurricane and wildfire-prone regions.

Insurance costs now make up almost 30% of total housing payments in Orleans Parish, Louisiana. This cost burden explains why New Orleans' home prices rose only 14% since 2018, while the national average jumped 55%. Research shows that home values typically drop 4.6% for every 10% increase in insurance costs.

Urban vs. suburban demand shifts

Young professionals flock to urban centers that offer walkability and nearby amenities. Families and remote workers prefer suburban areas with bigger homes, better price per square foot, and good schools.

NYC suburbs, including Long Island and Northern New Jersey, heat up as workers return to offices and boost commuter demand. Yet, suburban developments in coastal Florida and Texas struggle with rising insurance costs and climate concerns. Modern suburbs have evolved into complete communities with shopping, dining, and better transit options.

These location-specific factors are vital to maximize your selling potential in today's diverse regional market.

Choosing the Right Way to Sell: Agents, Cash Buyers, or Digital Platforms

Each selling method comes with trade-offs. The right choice depends on your timeline, financial goals, and risk tolerance.

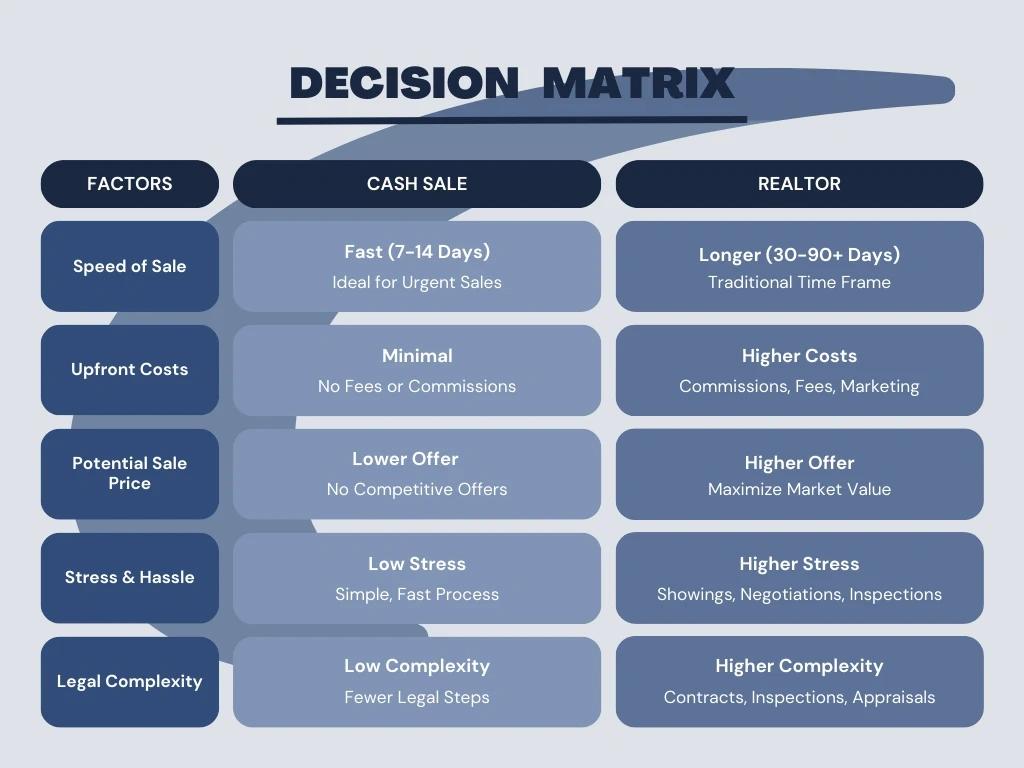

Each selling method comes with trade-offs. The right choice depends on your timeline, financial goals, and risk tolerance.Image Source: House Buyers of America

The home selling landscape of 2026 looks quite different from the traditional approach we once knew. Homeowners now have several paths to choose from, and each offers unique benefits based on what matters most to them.

Pros and cons of using a traditional real estate agent

Traditional agents still provide the best way to maximize your sale price. They take care of the marketing, handle tough negotiations, and manage all the paperwork while sharing their market knowledge. Recent studies show that agent-sold homes typically bring in $280,000 compared to $200,000 for owner-sold properties. The process takes time though - you should expect 60-90+ days. The cost includes a commission that usually runs between 5-6% of what your house sells for.

When cash buyers make sense (and when they don't)

Cash buyers give you a unique experience with speed and certainty - you could close in just 21 days. This route works great if your house needs repairs, you live out of state, or you've inherited a property. Sure, cash offers might come in lower than market value, but after you factor out repairs, staging, and agent fees, the money you walk away with often matches up well.

How digital platforms are changing the game

The digital world has altered the map of home selling completely. These days, sellers expect high-quality listing photos, virtual tours, and online ways to manage transactions. New sellers will be glad to know that 82% of agents say their clients love these tech tools. Compare your selling options and get your home's live value in minutes.

Costs, speed, and control: Comparing your options

Your best choice really comes down to what matters most to you. Traditional agents are your best bet if you want top dollar and don't mind waiting. Cash buyers make sense if you need a sure thing fast. Digital platforms hit the sweet spot with efficient processes at different service levels. You might get less money as things get more convenient, but state-of-the-art solutions keep closing this gap.

What Works Now (And What Doesn’t) When Selling

Traditional agents can help maximize sale price, but may require longer timelines and commissions.

Traditional agents can help maximize sale price, but may require longer timelines and commissions.Success in the 2026 housing market just needs updated selling strategies based on current data rather than outdated assumptions.

Overpricing is out: Why realistic pricing wins

Setting an accurate price from day one has become critical. Overpriced homes sit 68% longer on the market. Properties that need price cuts ended up selling for 8-10% less than correctly priced ones, in part because buyers often see reductions as signs of hidden problems. Recent comparable sales from the last 30-45 days provide the best guidance, as older data might not reflect current conditions.

Staging and repairs that actually pay off

Not every pre-sale investment delivers equal returns. Minor kitchen updates yield approximately 87% ROI, while bathroom refreshes return about 71%. Fresh exterior paint (152% ROI) and landscaping (238% ROI) consistently outperform interior renovations. Virtual staging has emerged as an affordable alternative that costs 90% less than traditional staging and helps homes sell 31% faster.

Timing your sale: Best time to sell a house 2026

Early May remains the optimal selling window. Homes sell 18% faster and for 5.9% more than average during this time. In spite of that, regional variations exist—southern markets perform better in winter months while northeastern markets peak later in spring. Local inventory levels provide better timing guidance than national trends.

Avoiding common seller mistakes in a stable market

Beyond pricing errors, today's sellers frequently make these mistakes:

- Poor online presentation (85% of buyers first view homes online)

- Rejecting early offers (first offers typically exceed later ones by 2-3%)

- Missing disclosures (leading cause of post-sale disputes)

- Making emotional decisions instead of responding to market feedback

Conclusion

The 2026 home selling market needs a custom strategy that fits your area and situation. Regional differences now matter more than national patterns. Some markets show strong growth while others see falling prices. Buyers have become more selective with mortgage rates between 6-6.5%. This has changed the game from previous years.

Your success in selling depends on how well you read the market. Homes need realistic prices now more than ever. Properties that ask too much stay on the market 68% longer. Quick wins come from smart upgrades. Exterior painting brings 152% ROI, and landscaping delivers an amazing 238% ROI. These work better than big indoor renovations.

The housing supply stays 12% lower than before the pandemic but keeps growing slowly. Early May proves the best time to sell in most areas. Homes sell 18% faster and fetch 5.9% more than average. Your local market should help you pick the right time to list.

The way you sell your home makes a big difference. You can pick between regular agents, cash buyers, or online platforms. Each choice affects your money and experience differently based on what matters most to you - price, ease, or speed.

Weather risks now affect home values a lot, especially in areas prone to disasters. Insurance costs have cut home values by about $43,900 in the hardest-hit ZIP codes. You need to think about this when setting your price.

The 2026 market brings its share of hurdles, but prepared sellers who adapt can still win. Look at your local data closely. Set real expectations. Pick a selling method that fits your needs. This way, you can direct your path through today's complex housing market and reach your goals.

FAQs

Q1. How have mortgage rates affected the housing market in 2026? Mortgage rates in 2026 are hovering between 6-6.5%, which has created a more selective and price-sensitive buyer pool. While this represents a slight improvement from previous years, it has still impacted buyer behavior and home affordability compared to the sub-3% rates of the pandemic era.

Q2. What are the best home improvements to make before selling in 2026? Exterior improvements offer the highest return on investment in 2026. Fresh exterior paint can yield a 152% ROI, while landscaping can provide up to a 238% ROI. Minor kitchen updates and bathroom refreshes are also beneficial, with ROIs of approximately 87% and 71% respectively.

Q3. When is the best time to sell a house in 2026? Generally, early May remains the optimal selling window, with homes selling 18% faster and for 5.9% more than average. However, regional variations exist. It's important to monitor local inventory levels and market conditions for the best timing in your specific area.

Q4. How has climate risk affected home values in 2026? Climate concerns have significantly influenced home values, particularly in disaster-prone areas. In the most affected ZIP codes, rising insurance premiums have reduced home values by approximately $43,900. Properties in hurricane and wildfire-prone areas have been particularly impacted.

Q5. What are the pros and cons of using a cash buyer to sell my home in 2026? Cash buyers offer speed and certainty, with closings possible in as little as 21 days. This option is particularly beneficial for houses needing repairs, out-of-state owners, or inherited properties. However, cash offers generally come in below market value, though the net proceeds can remain competitive when factoring out repair costs, staging expenses, and agent commissions.