Key Takeaways

Understanding real estate commission structures in 2026 can save you thousands on your home sale while ensuring you get the right level of service for your specific situation.

• Commission rates vary significantly by region and model - while the national average is 5.70%, rates range from 4.50% in Washington D.C. to 6.20% in Michigan, with discount brokers offering 1-1.5% listing fees.

• Hidden costs beyond commission can equal your listing fee - closing costs ($5,000-$15,000), inspections, staging, and transfer taxes often add substantial expenses that sellers overlook when budgeting.

• Post-NAR settlement changes give sellers more negotiating power - buyer agent compensation is now optional and negotiable, though most sellers still offer it to remain competitive in the market.

• Service quality directly impacts your net proceeds - full-service agents achieve higher list-to-sales ratios (over 100%) compared to limited-service brokers (92%), potentially offsetting higher commission costs through better sale prices.

• Calculate your actual net proceeds, not just commission percentages - minimum fees, effective rates, and total transaction costs matter more than advertised rates when determining your final payout.

The key is matching your commission structure to your market conditions, experience level, and desired involvement in the selling process. Whether you choose traditional full-service representation or alternative models, focus on the total value delivered rather than just the lowest advertised rate. A surprising 17% of home sellers used a Flat Fee MLS, Hybrid, or Limited Service Broker in 2025. The real estate world is changing faster as more people choose low commission realtor options.

The average combined commission rate sits at 5.70%. Listing agents usually charge 2.88% while buyer's agents ask for 2.82%. Many reduced commission realtors now offer listing fees as low as 1-1.5%. This could save you thousands when you sell your home.

The market looks brighter for 2026. The National Association of Realtors predicts existing-home sales will rise by 14% as mortgage rates drop to around 6%. Rate changes affect buyer activity by a lot. When rates fall from 7% to 6%, the Orlando market alone could see over 6,000 more buyers each month.

Florida's population keeps growing. In 2024, 27% of new residents came from other states and 5% moved from abroad. Sellers need to learn about commission structures in this changing market. More sellers question the traditional 6% commission model and prefer paying only for services they need.

This piece gets into what you'll really pay in real estate commissions in 2026. You'll learn about standard models, lowest realtor commission options, and how to review which structure works best for your sale.

How Real Estate Commission Structures Work in 2026

Real estate commission structures have changed a lot since the National Association of Realtors (NAR) settlement took effect in August 2024. Home sellers need to know these changes to make smart decisions.

Standard Commission Models Explained

The average real estate commission is 5.70% nationwide in 2026, which is a bit higher than 2025. This commission splits between two parties: the listing agent who works for the seller and the buyer's agent. Listing agents get about 2.73%, and buyer's agents receive 2.74%. Market conditions, property values, and service levels can change these rates. A $400,000 home would see total commission costs of $20,000–$24,000. Sellers with high-value properties or those in competitive markets often negotiate lower percentages.

Percentage-Based vs. Flat Fee Pricing

The traditional model uses percentage-based commissions where sellers pay based on their home's sale price. Flat fee services offer a different approach with a set price—usually $100 to $1,000—to list your property on the MLS. Sellers who choose flat fees can control pricing, showings, and negotiations better. This works well for experienced sellers or those with desirable properties, and they can save $7,000 to $30,000 compared to traditional models.

How Minimum Fees Affect Your Actual Cost

Many brokerages use minimum fees that can change your final costs. A 1.5% listing fee looks good until you learn about the $5,000 minimum fee that makes lower-priced home sellers pay higher rates. You'll also need to factor in photography, marketing expenses, and administrative fees. Your actual commission rate might end up different from what was advertised, especially with discount realtors.

Post-NAR Settlement Changes to Commission Payment

Commission terms are now negotiated directly between buyers, sellers, and their agents following the NAR settlement.

Commission terms are now negotiated directly between buyers, sellers, and their agents following the NAR settlement.The 2024 NAR settlement brought big changes to commission structures. Buyers must now sign agreements with their agents before they can tour homes. These agreements spell out services and payment terms. MLS platforms can't show commission offers anymore. Parties now negotiate these terms through direct communication outside the MLS. Sellers can still pay buyer agent fees if they want to—it's optional and negotiable now. Most sellers choose to cover buyer agent commissions to stay competitive, especially when dealing with first-time buyers.

What Sellers Actually Pay: Breaking Down the Numbers

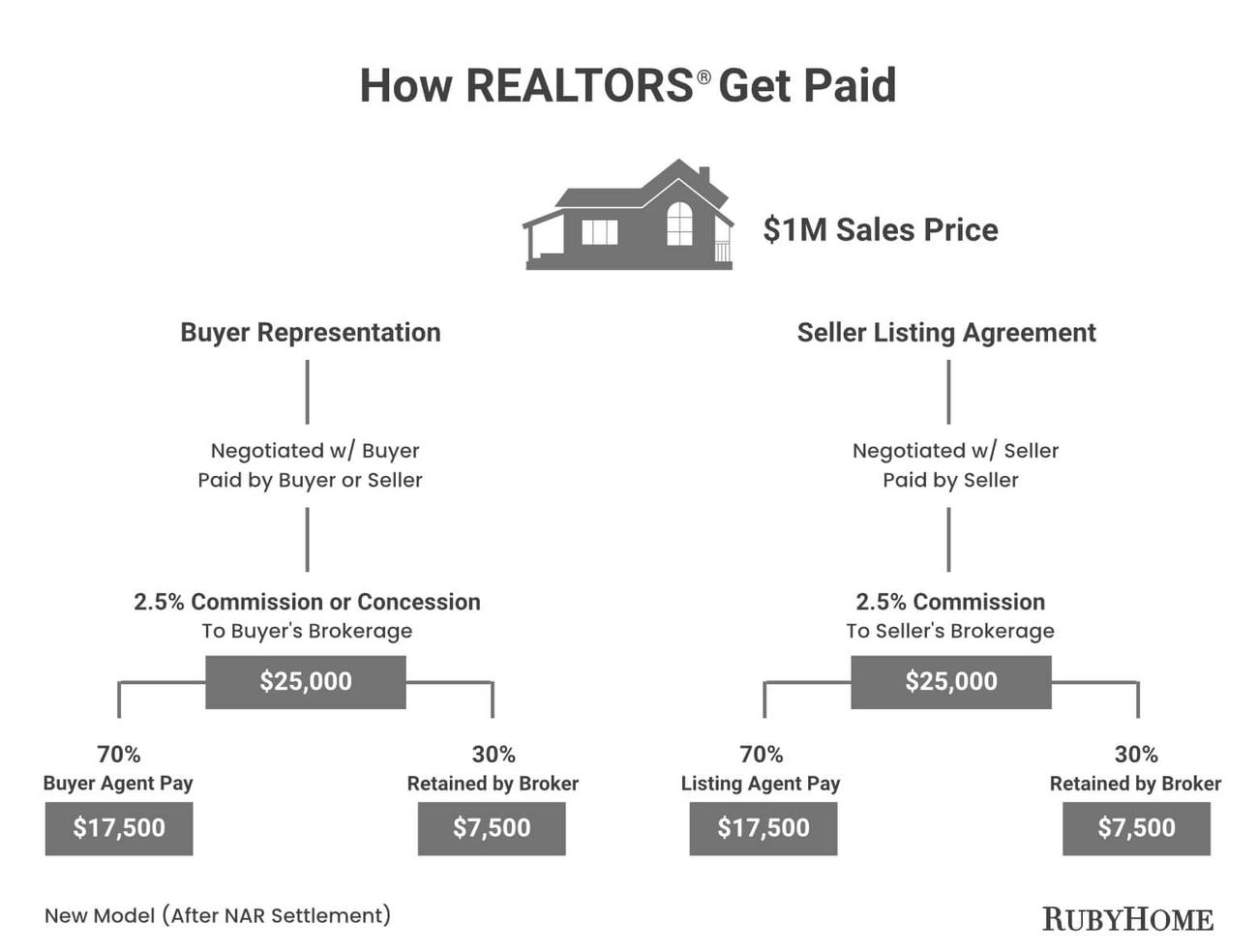

Example of how real estate commissions are negotiated and split between agents and brokerages after the NAR settlement.

Example of how real estate commissions are negotiated and split between agents and brokerages after the NAR settlement.Image Source: camgceb.org

The U.S. real estate market shows big differences in commission costs. Sellers often pay more than the percentage they see advertised.

Average Commission Rates by State and Region

The real estate commission average across the country sits between 5.57-5.70%. This splits between the listing agent (2.82-2.88%) and buyer's agent (2.75-2.82%). Regional rates show notable differences. The Pacific region averages 5.34%, while the Southwest leads with 5.74%. State-by-state variations are even more striking. Michigan's rates reach 6.20% , yet Washington D.C. stays low at 4.50%. States with pricier properties tend to charge lower percentages, though the total commission remains high.

Hidden Costs Beyond the Listing Fee

Sellers need to watch out for extra costs beyond the standard commission. Closing costs range from $5,000 to $15,000. These include title insurance (0.5-1% of sale price), escrow fees, and transfer taxes. You'll also need money for inspections, repairs, and staging before the sale. These extra expenses can match or exceed the listing agent's commission share, especially in states where transfer taxes run high.

Real-Life Scenarios at Different Price Points

Commission costs change a lot based on home prices:

- $270,000 home: Total commission averages $15,039

- $540,000 home: Total commission averages $30,078

- $890,000 home: Total commission averages $49,573

A $400,000 property might cost between $20,000-$24,000 in total commissions. This explains why many sellers look for low-commission realtors to save money.

Effective Commission Rate vs. Advertised Rate

What you see isn't always what you pay when it comes to commission rates. Minimum fees can change the actual rate, especially with lower-priced homes. To cite an instance, see how a low-commission realtor advertising 1.5% might set a $5,000 minimum fee. This means sellers of $300,000 homes pay 1.67% instead of 1.5%. The NAR settlement now prevents listing agents from showing buyer agent commission on the MLS. This creates room to negotiate but also makes total costs less clear.

Commission rates have slowly dropped from about 6% in the 1990s to around 5.3% today. Competition from discount brokers and reduced-commission realtors offering different fee structures drove this change.

Low Commission Real Estate Agents and Alternative Models

Low commission realtors have captured much of the market share in 2026. They give sellers options beyond the traditional 6% commission model. These options charge 1-1.5% listing fees compared to the standard 2.88%, which saves thousands on home sales.

How Reduced Commission Realtors Operate

Discount brokers run their business through two main approaches. Some make profits through higher transaction volume - they handle 60-100 transactions yearly while average agents complete just 6. Others use technology platforms that streamline processes and cut costs while keeping core services intact. Many brokers offer tiered packages that let sellers pick their preferred support level and pricing.

Full-Service vs. Limited-Service Options

Full-service agents provide complete support throughout the selling process. This includes pricing strategy, marketing, negotiations, and paperwork. Limited-service brokers split these services and charge only for specific components. NAR standards show that limited-service agents skip all but one of these core services: they don't organize listing appointments, present offers, or negotiate for sellers.

Discount Brokers: What's Included in the Lower Fee

Most discount brokerages cover MLS listings, simple marketing, documentation, and legal help. Here's what you get:

- Essential services: MLS listing access (reaching 80% of buyers) and simple marketing

- Mid-tier packages: Professional photography, pricing analysis, and negotiation support

- Premium options: Full representation for 1-2% success fees versus traditional 2.5-3%

When Lower Commission Means Lower Service Quality

Service limitations show up in several ways. Discount agents who manage more clients often take longer to respond. Some brokers might cut back on marketing or give less personal attention. The data proves that service quality affects results - limited-service brokers' list-to-sales ratio averages 92%, while full-service agents can exceed 100%. These lower final sales prices might cancel out any commission savings.

Evaluating Commission Options for Your Situation

You need to think over several factors when picking the right commission structure. Your specific needs, market conditions, and financial goals all play a role. A smart choice here could save you thousands without compromising on results.

Service Level Trade-Offs to Think Over

Performance-based agreements give you an alternative to fixed commissions. These tie agent compensation to outcomes—agents earn more when they exceed target prices or secure multiple offers. Price reductions hit your wallet harder than slightly higher commission rates. Look for agents who can state their value through solid services: pricing strategy, contract risk mitigation, and negotiation tactics.

Market Conditions That Affect Commission Negotiation

Homes in markets with first-time buyers or FHA/VA loans need competitive buyer agent compensation to stay appealing. However, properties that attract cash buyers or investors can do well with lower buyer agent offers. Flat fee models shine especially when you have hot urban markets like Austin or Charlotte.

Calculating Your Net Proceeds with Different Models

What matters most is the money you keep after paying all agents—not just the initial bid amount. A net proceeds calculator helps you compare different commission structures. Top-performing agents often sell homes for up to 10% more than average agents, and this is a big deal as it means that higher commission costs might be worth it.

Questions to Ask Before Choosing a Commission Structure

Take time to gage your comfort level with handling showings and negotiations. Know your state's average commission rates. Ask about any hidden fees or contract limitations. Find out how the agent plans to handle buyer agent compensation negotiations after the NAR settlement.

Conclusion

Real estate commission structures have altered the map by 2026. Sellers can now choose from multiple ways to pay their agents. The national average commission stays at 5.70%, but new models charging just 1-1.5% are gaining popularity.

These commission structures become more vital as the market picks up speed. A $400,000 home sale can cost $20,000-$24,000 in total commissions - that's much of your equity. Your specific situation matched against available commission options could save you thousands.

Market conditions shape which commission structure fits your property best. Properties with many first-time buyers nearby might do better with competitive buyer agent fees. Hot urban markets could succeed with flat fee services. Service levels affect outcomes by a lot - full-service agents usually achieve higher list-to-sales ratios than limited-service options.

Look beyond commission percentages and calculate your actual net proceeds under different scenarios. Effective commission rates often differ from advertised ones due to minimum fees and extra costs. The key is finding an agent who delivers value through strategic pricing, solid marketing, and strong negotiation skills.

The NAR settlement has changed commission rules. Buyer agent compensation is now optional and open to negotiation. Notwithstanding that, most sellers still offer buyer agent fees to stay competitive. Your choice between traditional or alternative commission models should focus on true costs and benefits. This helps maximize your sale proceeds while getting the service level you need.

FAQs

Q1. What is the average real estate commission rate in 2026? The average combined real estate commission rate in 2026 is approximately 5.70% of the home's sale price, typically split between the listing agent and the buyer's agent.

Q2. How do low commission real estate agents operate? Low commission realtors often charge 1-1.5% listing fees instead of the standard 2.88%. They maintain profitability through higher transaction volumes or by using technology to streamline processes, offering tiered packages that allow sellers to choose their desired level of support and pricing structure.

Q3. What factors affect real estate commission negotiations? Market conditions, property type, and buyer demographics influence commission negotiations. Properties in markets with first-time buyers or FHA/VA loans may benefit from offering competitive buyer agent compensation, while those in hot urban markets might succeed with flat fee services.

Q4. How has the NAR settlement affected real estate commissions? The 2024 NAR settlement has made buyer agent compensation optional and negotiable. Commissions can no longer be advertised on MLS platforms, and buyers must now sign written agreements with their agents before touring homes, outlining services and compensation.

Q5. What should sellers consider when choosing a commission structure? Sellers should evaluate their specific needs, market conditions, and financial goals. They should consider service level trade-offs, calculate net proceeds under different models, and ask about hidden fees or contract limitations. It's important to focus on the value provided through services like strategic pricing, effective marketing, and strong negotiation skills rather than just the commission percentage.

Sources & Further Reading

This article is informed by publicly available data, regulatory guidance, and market analysis from the following sources:

- National Association of Realtors (NAR)

What the NAR settlement means for home buyers and sellers

https://www.nar.realtor/the-facts/what-the-nar-settlement-means-for-home-buyers-and-sellers - Federal Reserve

Trends in real estate broker compensation

https://www.federalreserve.gov/econres/notes/feds-notes/commissions-and-omissions-trends-in-real-estate-broker-compensation-20250512.html - CapCenter

What’s actually changed since the NAR settlement

https://www.capcenter.com/learning/article/whats-actually-changed-since-the-nar-settlement - NerdWallet

Understanding discount real estate brokers

https://www.nerdwallet.com/mortgages/learn/discount-real-estate-broker - HomeLight

Discount real estate brokers and commission models

https://www.homelight.com/blog/discount-real-estate-brokers/ - HomeLight

Home sale net proceeds calculator and seller costs

https://www.homelight.com/blog/home-sale-net-proceeds-calculator/ - Opendoor

Hidden fees when selling a house

https://www.opendoor.com/articles/hidden-fees-when-selling-a-house - Better.com

Who pays real estate agent fees

https://better.com/content/who-pays-realtor-fees - Anytime Estimate (market averages)

Average real estate commission rates

https://anytimeestimate.com/home-selling/average-real-estate-commission-rates/